Institute for Portfolio Alternatives

AltsGlobal 2025 conference

Key Insights from London

November 2025

Langham Hotel, London

INTRODUCTION

The 2025 IPA GlobalAlt Conference in London convened an unusually broad and influential cross-section of global private-markets leadership — spanning asset managers, wealth platforms, institutional allocators, secondaries specialists, regulatory experts, and macroeconomic forecasters. Across two days of intensive discussion, a compelling case was made that the democratization and globalization of private markets has moved beyond the conceptual stage and is now actively reshaping market structure, product design, operations, regulation, and the macroeconomic context within which capital is formed.

Importantly, the attendees at the conference are all fundamentally true believers in private markets, and their enthusiasm is not necessarily shared by all market participants or investors.

However, across three days, conference attendees made a compelling case that private markets are no longer a side-car allocation for institutions or a niche offering for wealthy families. Instead, they are becoming an increasingly essential component of global household portfolios, retirement systems, and cross-border financial flows.

At base, the dialogue in London suggested a system in transition — one where private markets are expanding rapidly, but where the supporting regulatory architecture, operational plumbing, and macroeconomic environment remain in flux.

As Neil Hoyne, of Ares Wealth Management explained: “If you look at the way the semi-liquid landscape has moved in the last five years… there’s just constant product coming to market. More distributors are trying to get into private markets, but these funds don’t function like a UCITS model… There will, over time, be a swell to say we need to standardize. We need to figure out the most efficient way of doing things.”

This memo synthesizes the most important analytical takeaways, drawing on the panel discussions, the macroeconomic briefing delivered by the Economist Intelligence Unit, and the evolving UK and European regulatory context — particularly the emergence of the Long-Term Asset Fund (LTAF) as a foundational mechanism for expanding access to illiquid investments. The result is a cohesive examination of the forces reshaping alternatives at a global level.

-

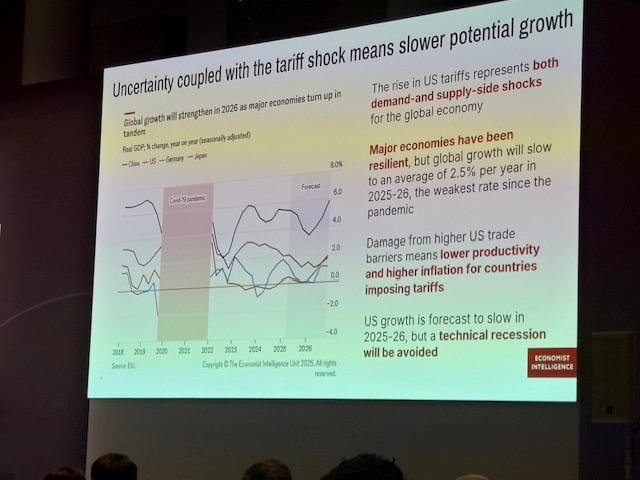

A MACROECONOMIC ENVIRONMENT DEFINED BY STRUCTURAL TRANSITION

The conference opened with a rigorous assessment of the global economic environment from the Economist Intelligence Unit (EIU), which provided critical context for understanding the near-term and structural forces influencing alternative investments. The EIU emphasized that although inflation has moderated and rate-cut cycles have begun, the global economy is transitioning into a regime characterized by higher-for-longer real rates, persistent geopolitical uncertainty, and shifts in global trade architecture.

A central point underscored through both narrative and data was that the U.S. economy has demonstrated remarkable resilience despite tariff shocks and policy uncertainty, but that the full lagged effects of these shocks have yet to materialize. One of the most consequential data points highlighted was the historic divergence between the effective mortgage rate paid by U.S. homeowners and prevailing market mortgage rates — the widest since the early 1980s — which has weakened the transmission of monetary policy and reduced housing turnover. This has significant implications for real estate, residential credit, and broader consumer behavior.

Against this backdrop, central banks are easing cautiously. The Federal Reserve resumed rate cuts in September, the European Central Bank is expected to complete one final cut before pausing, and the Bank of England retains more room to ease. Global monetary conditions should become more supportive in 2026, but the era of cheap capital is structurally over.

The EIU’s currency outlook further underscored this theme of structural adjustment. The U.S. dollar is expected to depreciate modestly over the next two years as U.S. protectionism encourages diversification, but meaningful displacement of the dollar remains unlikely due to the scale and depth of the U.S. Treasury market. The macro briefing also examined the global semiconductor super-cycle, with AI-driven capital expenditures expected to support investment across digital infrastructure and technology supply chains.

Emerging markets remain the fastest-growing contributors to global GDP, particularly in India, the Middle East, and East Africa, reinforcing the long-term investment case for global private markets exposure.

-

THE GLOBAL WEALTH CHANNEL AS THE NEW CENTER OF GRAVITY

A central theme throughout the conference was that the wealth channel has replaced the institutional channel as the primary engine of private markets growth. Demand from high-net-worth and mass-affluent clients is expanding rapidly, particularly across Europe, the Middle East, and Asia. Yet demand is not the constraint — distribution infrastructure and regulatory fragmentation are. Wealth clients increasingly expect institutional-quality access to private markets, but the mechanisms for delivering that access — including suitability frameworks, liquidity structures, and reporting standards — remain uneven.

As Emma Corey, Alternatives Specialist, HSBC Global Private Banking explained “We don’t ever say the word ‘semi-liquid’… When we talk about redemptions, we reduce expectations that pro-rata gating will happen, so clients are aware of these events. Alternatives has always been part of our offering, but it’s critical that clients understand realistic return expectations, risks, and terms.”

Karim Leguel of J.P. Morgan noted that the shift toward individual investors “is happening faster than platforms and product structures can adapt.” This trend has major commercial implications, as investor expectations around transparency, liquidity, and communication increasingly mirror those of public-market clients.

-

OPERATIONAL INFRASTRUCTURE: THE HIDDEN DETERMINANT OF GLOBAL SCALE

Panelists from Blackstone, Eisner, and others emphasized that operational scalability is now a decisive competitive differentiator. Cross-border distribution requires sophisticated infrastructure: transfer-agency systems, multi-currency settlement, standardized KYC/AML processes, automated subscription flows, and harmonized data reporting. Evergreen structures intensify these demands as managers must deliver frequent valuations and continuous servicing.

As Lata Vyas of Brown Brothers Harriman put it, “Managers cannot expand globally on spreadsheets.” Nicholas Husseyag noted that evergreen structures force managers to “run a private-equity engine with a mutual-fund service model.”

-

SECONDARIES AS A SYSTEM-WIDE LIQUIDITY ENGINE

Secondaries specialists underscored that their market has become a structural liquidity valve for the entire private-markets ecosystem. Denominator effects, slower fundraising, and semi-liquid wealth vehicles all heighten the need for portfolio-level liquidity solutions. LP-led sales have accelerated, GP-led transactions remain robust, and valuation dynamics have begun to stabilize as rate expectations settle.

The traditional distinction between LP-led and GP-led transactions is eroding, replaced by a unified focus on matching liquidity profiles with asset characteristics.

-

THE UK WEALTH MARKET: AN INFLECTION POINT

Demand for alternatives in the UK wealth market is rising rapidly, driven by demographic shifts, advisory adoption, and the evolution of regulatory frameworks. Yet education remains the primary barrier. Advisors and clients must navigate liquidity mechanics, valuation methodologies, fee structures, and distinctions across asset classes — areas requiring clearer communication and regulatory refinement.

Suitability standards, appropriateness tests, and cross-border marketing rules will continue to influence the pace and shape of UK market development.

-

THE FUTURE OF RETIREMENT: GLOBAL DIVERGENCE

Retirement systems in the UK, EU, and Australia are integrating private markets more rapidly than the United States. Structures such as the LTAF and ELTIF 2.0 create explicit regulatory pathways for long-term investing by retirement savers. U.S. ERISA constraints continue to impede similar progress, raising long-term competitiveness questions about global capital formation.

-

THE LONG-TERM ASSET FUND: A DEFINING UK INNOVATION

The LTAF emerged as a central topic across panels. Designed to channel long-term capital into illiquid assets, the LTAF aligns redemption terms with the economic nature of underlying investments. It supports DC pension participation, improves governance, and positions the UK as a leading jurisdiction for long-term investment vehicles. Several panelists described the LTAF as the UK’s most important regulatory innovation in a decade.

CONCLUDING THOUGHTS

A number of structural themes emerged repeatedly across the panels — themes that, taken together, help define the trajectory of private markets for the coming decade.

- It is now evident that the global wealth channel will be the primary engine of growth, eclipsing the traditional dominance of institutions. The democratization of access, once theoretical, is now materializing in client portfolios and product shelves worldwide. This shift places new emphasis on operational infrastructure as a strategic determinant of competitiveness. The ability to scale onboarding, valuations, reporting, and cross-border servicing has become as important as originating compelling assets.

- The conference demonstrated that evergreen and semi-liquid structures have entered the mainstream, reshaping liquidity expectations and requiring new governance and risk-management models.

- The rapid expansion of these structures is increasing reliance on the secondaries market as a system-wide liquidity engine. What began as a niche segment now influences the resilience of the entire private-markets ecosystem.

- The long-term savings systems of the UK, EU, and Australia showed that retirement markets globally are moving toward greater incorporation of alternatives, recognizing their role in generating long-horizon, inflation-resistant returns.

- Even as jurisdictions experiment with new access frameworks — from the UK’s LTAF to Europe’s ELTIF reforms —regulatory convergence is inevitable, though gradual. Harmonization across marketing rules, liquidity standards, and valuation practices will take time, but the direction of travel is unmistakable.

- Finally, the macroeconomic backdrop reinforces the strategic relevance of private credit, infrastructure, and real assets. With structurally higher real rates, geopolitical fragmentation, and global investment increasingly defined by digital infrastructure and the energy transition, proponents believe these asset classes appear poised to anchor long-term private-markets growth.

Taken together, these forces point to a private-markets ecosystem that is not merely expanding, but fundamentally transforming — economically, operationally, and institutionally.

The challenge for policymakers and market leaders will be to ensure that this transformation unfolds responsibly: with adequate investor protections, resilient liquidity structures, scalable operational frameworks, and regulatory regimes that support both innovation and long-term stability.

Private markets seem to be entering their global moment. The question for the coming decade is how to shape systems capable of sustaining this growth while maintaining the transparency, integrity, and investor protection on which global capital formation depends.

###